Ban Mai

Prices remain high compared to other property segments, and difficulties in generating investment returns have pushed resort real estate into a near-standstill — with virtually no successful transactions taking place.

According to DKRA Group’s August 2024 real estate market report, the resort property segment still shows no signs of recovery in either supply or liquidity.

Specifically, 2,180 resort villas were released for sale. Supply increased slightly compared to the previous month but was still 5% lower than the same period in 2023.

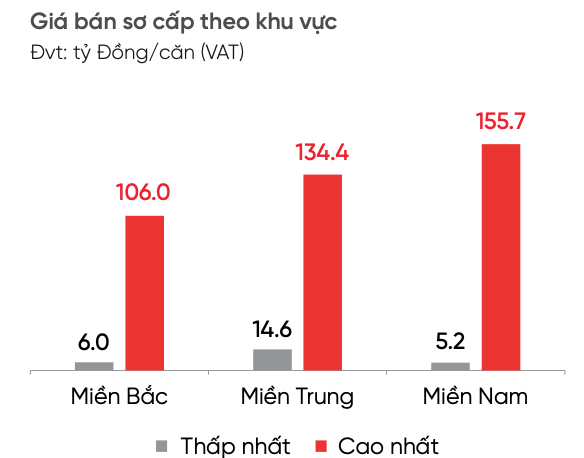

Primary prices for resort villas remained flat, while secondary prices continued to see loss-cutting reductions of 10%–20%.

The market continues to face significant difficulties in both liquidity and price growth potential, as investor confidence and recovery signals in this segment remain extremely weak

For the beachfront townhouse and shophouse segment, supply in August 2024 reached approximately 2,907 units, all of which were existing inventory from older projects launched many years ago. Market liquidity has nearly frozen; most projects have closed sales activities, resulting in no recorded transactions over the past month.

Primary market prices remained unchanged, while secondary prices continued to be cut by 30–40%, yet liquidity remains extremely weak.

Across the entire market, buyer demand has dropped sharply, no new supply is appearing, and large volumes of high-value inventory persist—factors that have created significant challenges in recent months, pushing this segment into an extended “hibernation cycle.”

Forecasts from DKRA Group also indicate that the market will continue to face numerous difficulties and challenges in the remaining months of the year, as the legal framework for this segment remains unclear, liquidity stays low, and investor confidence continues to decline.